At-A-Look

A great Va home loan also offers gurus such as for instance all the way down rates of interest, it’s not necessary to have individual financial insurance coverage, potentially zero downpayment, plus.

Along with brand new mortgage loans, Virtual assistant finance are used for bucks-out or straight down interest refinancing, in the event you already removed an excellent Virtual assistant mortgage on prior.

The usa bodies created the Va financing program more 75 in years past to assist veterans get affordable construction. Which have 2021 an archive-breaking year to own Virtual assistant fund, each other to order homes and to refinance, the applying remains a significant financing for qualified people. 1 But how exactly create Va fund work, and you will just who qualifies?

Just how a great Virtual assistant Financial Performs

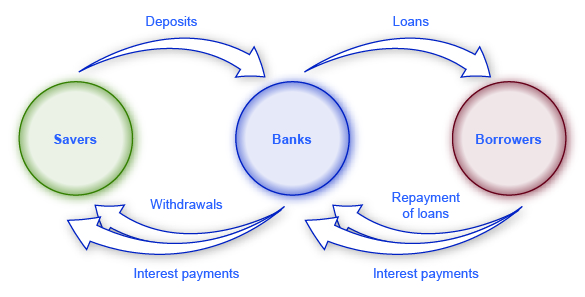

Many borrowers thought a Virtual assistant financing is simply an immediate mortgage from the authorities. In fact, the fresh new Virtual assistant generally promises simply components of the loan so you’re able to a good separate lender, will a lender, borrowing bank, otherwise mortgage company. The lending company also provides a unique loan conditions since Va provides due to the fact a great backer, promising no less than a limited incentives if for example the loan was to standard. On backing of one’s Va, lenders feel much warmer offering consumers pricing-rescuing loan terms.

Just after being qualified, eligible individuals located a certification out-of Qualifications (COE) about Virtual assistant. So it COE is then included in a portfolio along with other information constantly made available to an exclusive lending company when entry financing application, instance income, debts, and you will credit file.

The benefits of good Va Home loan

Even if qualified Va loan individuals might still use an excellent conventional financial because of their financial, an effective Virtual assistant financing has numerous advantage over almost every other mortgage brokers. dos Prominent masters are:

- No otherwise low down repayments: Many Va-supported loans not one of them a down-payment. Yet not, some lenders might require one to, particularly for higher priced features.

- Zero individual home loan insurance coverage requisite: Many reduced or no down-payment money want individual home loan insurance policies (PMI), however, a Va loan will not, that may lower the month-to-month price of a good Va financial.

- No lowest credit rating so you’re able to meet the requirements: Brand new Va does not require the absolute minimum credit rating to acquire an effective Va home loan. Your credit rating are still an integral part of a Va loan character and certainly will for this reason influence financing words, but the Virtual assistant demands loan providers to get into all software not only the score before you make a last choice and you will form words.

- Virtual assistant advice: The Va features offices across the country staffed to aid borrowers, whether they need help applying, suggestions in the event the they have fell about to your costs, or perhaps possess concerns throughout the length of the loan. 3

- Probably most readily useful rates of interest: The pace linked to a mortgage could possibly get fluctuate dependent on financing proportions, the borrower’s financial things, and venue. An average of, VA-backed loans generally have straight down interest rates than just conventional installment loans online Oakland New Jersey finance. 4

Manage I Be eligible for a beneficial Va Mortgage?

You will find some teams that can be eligible for a good Va mortgage. Of numerous qualified borrowers get into one of four categories:

- Veterans: Based on once you offered, length-of-solution standards are different, anywhere between ninety total times of effective provider to help you twenty-four persisted months. 5 Otherwise meet with the minimum active-responsibility provider requirement according to once you served, you might still manage to be eligible for a COE in the event the you used to be discharged for sure eligible explanations, particularly handicap, a particular medical condition, or adversity.

- Active-duty services members: So long as you’ve been providing for around 90 proceeded weeks, you may be entitled to a good Va financing.

- Federal Guard professionals: You can be eligible for an effective Va mortgage if you have had during the minimum ninety days out-of low-training energetic-obligations solution, or was basically honorably released or retired after half dozen creditable decades into the the fresh Federal Guard.

- Chose Reserve players: Picked Reservists normally qualify just after about 3 months out-of low-degree energetic-obligation services, or immediately after half dozen creditable ages regarding Chosen Put aside and another of your pursuing the: honorary launch, old-age, move into Standby Reserve immediately after respectable service, otherwise repeating services throughout the Chosen Reserve.

There are also authoritative systems out-of Virtual assistant fund accessible to certain categories of being qualified some one, eg Native American pros. These Virtual assistant funds can get bring extra benefits, as well as low interest rates, limited closing costs, without down-payment oftentimes. eight To see if your meet the requirements, you could potentially apply for your own COE from Va eBenefits portal, using your home loan company, otherwise thru mail.

Exactly what Costs and Restrictions Are on a Virtual assistant Financing?

Even with faster will cost you, Va fund possess some charges and limitations. Brand new insights are different with the terms of the borrowed funds, however preferred can cost you and you may constraints become: